Bank Bridge

Embark on a Financial Transformation Journey with APPower Bank Bridge

In the bustling corridors of Construction Enterprise, a tale of transformation unfolded. Burdened by the complexities of manual banking transactions, Construction Enterprise faced a pivotal decision: succumb to the inefficiencies or embrace innovation. The turning point came with the introduction of APPower Bank Bridge, a beacon of change that illuminated a path toward seamless financial operations.

Meet Iza, the CFO of Construction Enterprise

Iza, with years of experience navigating the intricate landscape of enterprise finance, recognized the need for a paradigm shift. Endless hours spent on manual payment processing and the constant threat of errors cast a shadow over the efficiency of her team. It was time for a change, a change that would redefine the way Construction Enterprise approached its financial journey.

The Challenge

As Iza delved into the daily rigors of manual banking operations, a common theme emerged – the struggle for efficiency and the ever-present risk of errors. Duplicate transfers, manual reconciliation headaches, and the looming specter of potential fraud became a formidable challenge. The finance department yearned for a solution that would not merely address these issues but propel them toward a future of unparalleled efficiency.

Enter APPower Bank Bridge

APPower Bank Bridge emerged as the hero in Construction Enterprise’s narrative, offering a suite of features that transcended conventional ERP solutions:

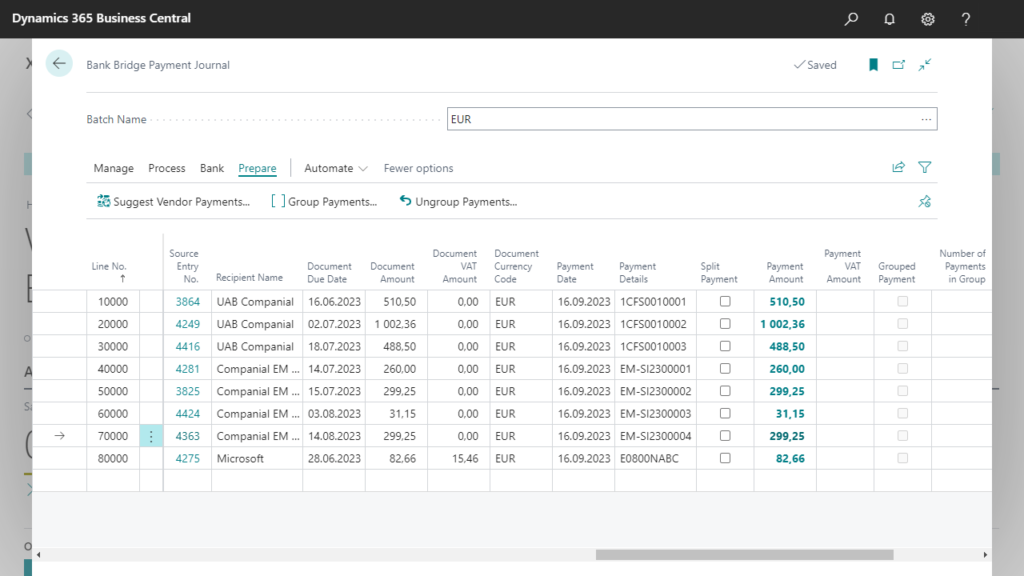

- Effortless Payment Processing: Iza and her team bid farewell to the laborious task of manual payment preparation. APPower Bank Bridge allowed them to seamlessly prepare and export payments directly from Business Central, liberating valuable time and resources.

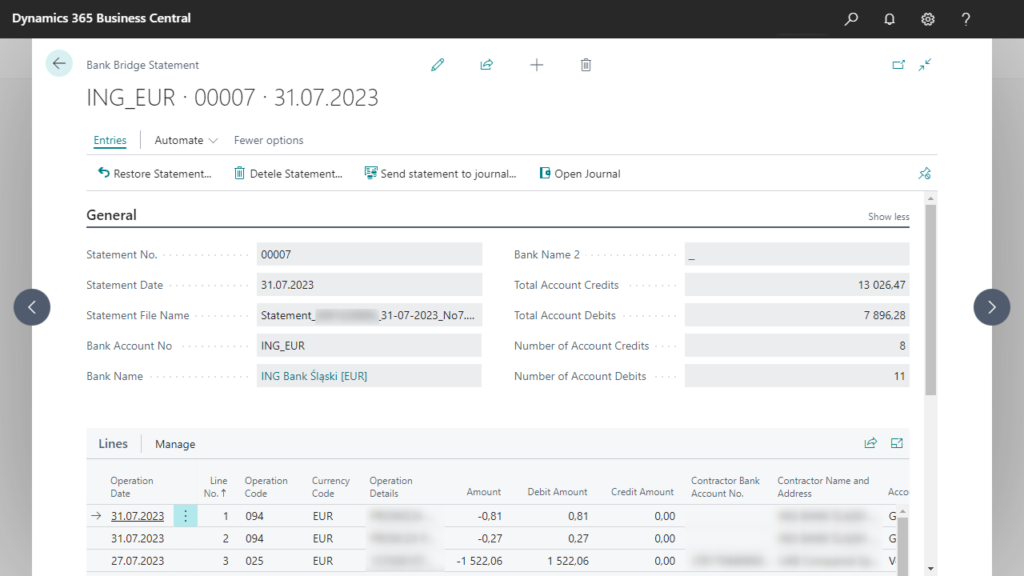

- Automated Bank Statement Handling: The import of bank statements became a breeze. Iza witnessed the automation magic as APPower Bank Bridge recognized vendors and customers, applying ledger entries with surgical precision, eliminating the manual reconciliation headache.

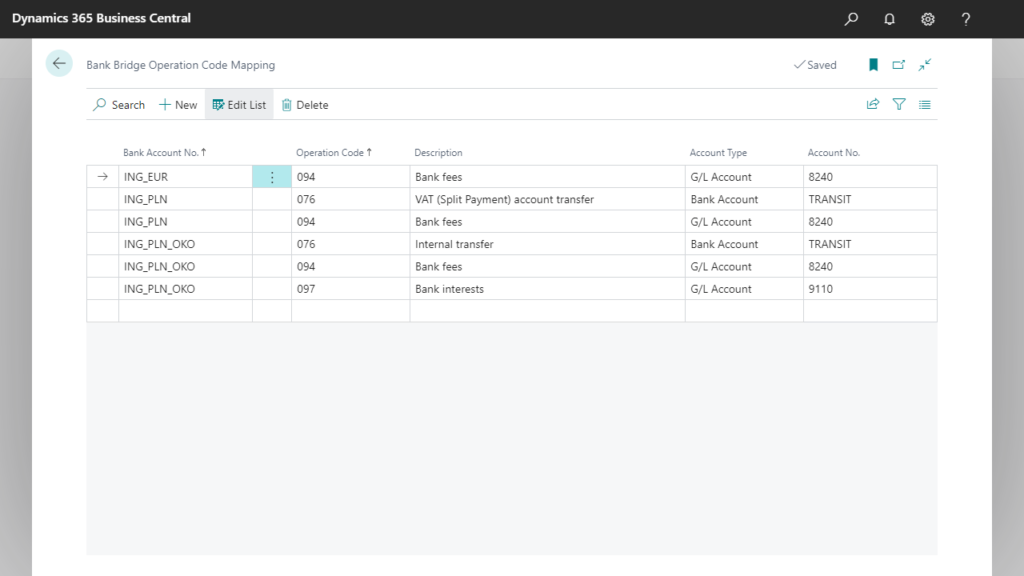

- Customizable Bank Operations Mapping: The ability to map bank operation codes to accounts was a game-changer. Managing bank charges and other transactions during statement import became an effortless endeavor.

- Enhanced Cash Receipt Journal: The extension for the standard Cash Receipt Journal brought clarity to statement balances. Iza now effortlessly verified balances in both the bank account’s currency and the local currency.

- Secure and Efficient Communication: Explore the option to implement direct communication with the bank’s API, enhancing the security and efficiency of your financial transactions.

- Comprehensive Archive: Maintain a thorough archive of bank transfers and statements, providing a clear audit trail for your financial records.

The Transformation Unveiled

As Construction Enterprise embraced APPower Bank Bridge, the transformation was palpable. Iza’s finance team witnessed a surge in productivity, errors became a relic of the past, and the fear of fraud dissolved into a distant memory. The direct communication option with the bank’s API added a layer of security, while the comprehensive archive became the bedrock of accountability.

Results

- Increased Productivity: By minimizing manual work and automating critical processes, Construction Enterprise experienced a significant boost in their finance department’s productivity.

- Error Reduction: APPower Bank Bridge virtually eliminated the risks associated with manual payments, ensuring accurate transfers and preventing duplicate transactions.

- Streamlined Communication: The direct communication with the bank’s API enhanced the security and efficiency of financial transactions.

- Thorough Documentation: The comprehensive archive of bank transfers and statements provided Construction Enterprise with a clear audit trail, supporting compliance and accountability.

Your Financial Revolution Awaits

Ready to script your own success story? Transform your financial operations with APPower Bank Bridge today. Embrace efficiency, accuracy, and unprecedented success. It’s time to redefine your financial journey.

Unlock the Power of APPower Bank Bridge – Your Catalyst for Financial Excellence.

Effortless Payment Processing

Seamless preparation and export of payments directly from Business Central, liberating time and resources.

- Prepare and export payments directly from Business Central, saving valuable time and resources.

- Group multiple payments destined for a single vendor into a seamless, consolidated transfer.

- Organize payment journals for specific accounts, currencies and payment methods.

Automated Bank Statement Handling

Benefits of automatic statement import, precise recognition of suppliers and customers.

- Import bank statements directly into Business Central for swift and error-free reconciliation.

- Recognize vendors and customers automatically, applying ledger entries with precision.

- Control the number of operations and the totals of debit and credit operations.

Bank Operations Mapping

Map bank operation codes to accounts, effortlessly managing bank charges and other transactions during statement import.

- Set default accounts for individual bank account operations to further automate the process of importing and posting bank statements.

- Map bank operation codes to any account type that exists in general journals and cash receipt journals.

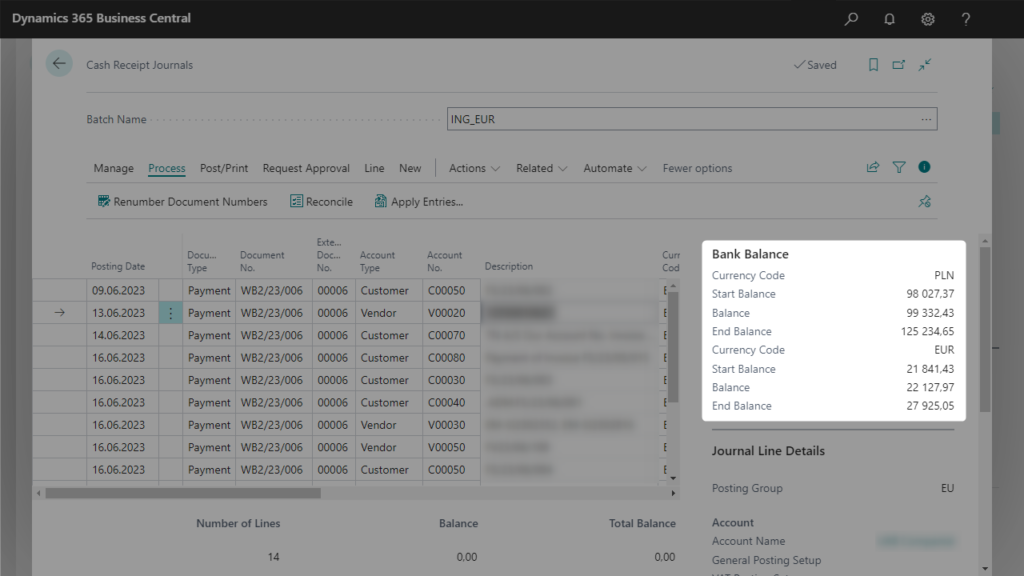

Enhanced Cash Receipt Journal

Utilize our extension for the standard Cash Receipt Journal, ensuring easy verification of statement balances.

- Verify the Start balance and End balance of the statement before you post the statement.

- Verify the balances in the currency of your bank account and in the local currency.

- Post multiple bank accounts to the same G/L Account and reconcile balances for individual bank accounts without any problems.

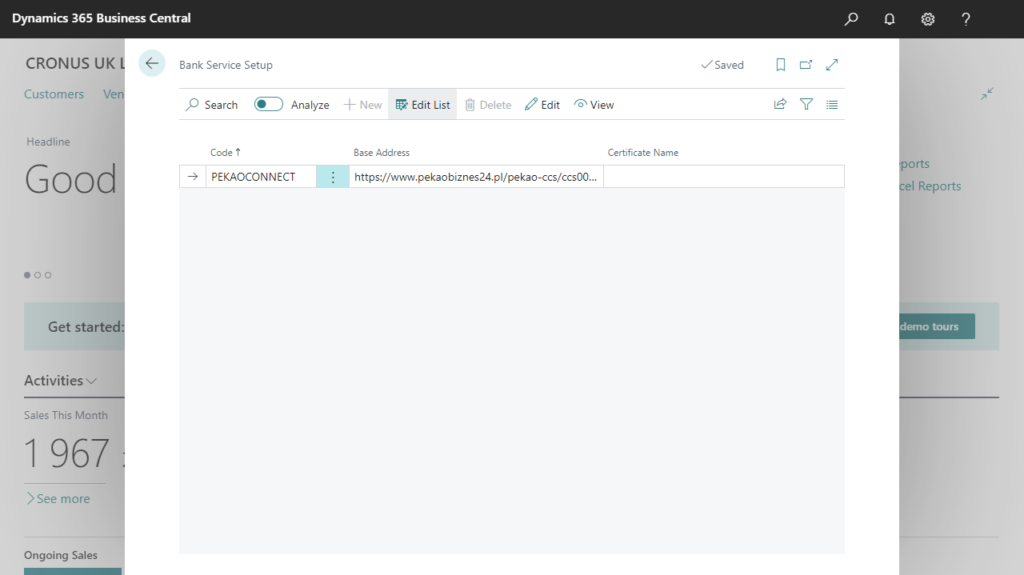

Secure and Efficient Communication

Integrate directly with the bank’s API for effortless and secure communication.

- Safeguard financial transactions with a direct connection to the bank, minimizing the risk of unauthorized access and ensuring data integrity.

- Receive real-time updates on transaction statuses, allowing for prompt decision-making and reducing the dependency on manual checks.

- Prepare your financial systems for the future by integrating with the bank’s API, ensuring scalability and adaptability to evolving business needs.

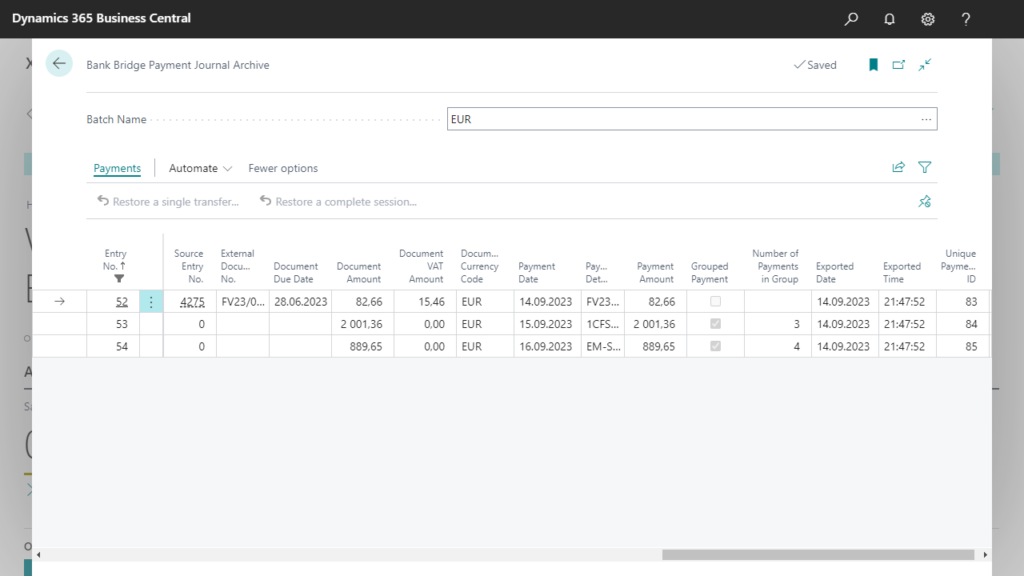

Comprehensive Archive

Maintain a thorough archive of bank transfers and statements, providing a clear audit trail for your financial records.

- Thanks to the archive, transfers will not be generated again, even though the statement has not yet been posted and payables entries are not settled.

- Restore transfers from the archive as needed, with full tracking of the restoration maintained.

- Maintain an archive for processed bank statements as well.